PWC’s sports industry report highlights a number of sports sponsorship considerations for 2023 from a brand, rights holder and investor perspective. The report summarises growth expectations and key market forces and deep dives into six topics they believe will shape the future of the sports sponsorship industry. Each section provokes a discussion on how the world of sports is likely to evolve and adapt in the coming years.

Sports sponsorship industry recovering well post-Covid

Commercial growth estimates have returned to pre-pandemic levels and it is expected that institutional investment in sports will increase, driving progressive change and future growth. Furthermore, the report identifies the key initiatives contributing to the growth of women’s sports, highlighting the important role the media must continue to play. In addition, the increasing interest from big tech in sport and the impact this might have on future media rights values is addressed, and for the first time, industry leaders have pointed to the challenges of realising returns on the continued investment in data-led growth strategies. The growing prominence of sustainability on sport’s strategic agenda, a growing, albeit cautious focus on Web3 and the continued, smart stadia-led developments in enhanced fan experience and diversified revenue streams are also covered.

Useful sports sponsorship context for 2023

The industry is characterised by a spirit of optimism. This is a sentiment shared across all territories, but North America and the Middle East markets in particular are confident of significant growth. Revenue is expected to increase with the women’s sports market playing a critical part in future growth.

- Over 75% of experts expect women’s sports revenues to grow by more than 15% in the next 3 to 5 years

- 50% of participants feel that widening media coverage would have the greatest impact on the growth of women’s sports

- 76% of respondents feel that large, non-traditional tech players are best positioned to win the battle for future sports media and broadcasting rights

- 74% of organisations surveyed do not have a Web3 strategy

- Over 40% of respondents feel that Web3 and blockchain technology will provide a significant opportunity for sports organisations in collectables (trading cards, videos and sporting items)

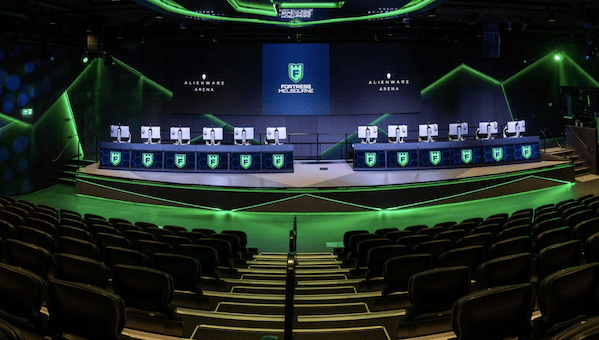

- 65% of respondents believe that the scale of the investment in hardware and software is the greatest barrier to harnessing the smart stadia opportunity

- 48% of executives feel that changing organisational culture is the most significant challenge when implementing a comprehensive ESG strategy

- Among the organisations surveyed, environmental sustainability was the least advanced component of ESG

- Less than 60% of the respondents claimed to be successfully monetising data collected from fans

- More than 83% of executives believe that institutional investment will continue to grow in the next 3 to 5 years

Summary of key 2023 sports industry insights

- Compared with last year, the perceived market growth outlook has improved from 5% to 6.5%. The European market has the most conservative outlook for the next 3 to 5 years. North America and the Middle East anticipate significant growth fuelled by the media rights market in the US and the significant investment appetite for major sports projects in the Middle East

- Premium sports rights remain must-have content around the world. This is reflected in the growth estimates for the upcoming years. Optimism is fuelled by strong viewership, increased competition for rights and differentiated rights monetisation models (e.g. Apple, Amazon and Google)

- A 6.6% growth rate over the next 3 to 5 years in sports club and franchise valuations is forecast. This positivity is underlined by the increase in sports M&A activity seen worldwide and recent values achieved. The relative scarcity of premium assets combined with increasing demand from new investors, such as Private Equity firms and multi-club franchise owners, is a key driver of increased team valuations

- The top five market forces driving opportunity are i) Transforming media landscape, ii) Growth of women’s sport, iii) Changing fan preferences and behaviours, iv) Increasing importance of environmental, social and governance (ESG), and v) Growing voice and influence of fans

- The top four market forces presenting threats are i) Increased cost of living/inflation, ii) Potential economic slowdown, iii) Geopolitical instability, iv) Tightening regulatory frameworks

- Increased activity levels from institutional investors. Sports organisations are looking for additional resources to remain competitive both on and off the pitch, whilst investors have been buoyed by the underlying resilience of consumer demand, as demonstrated through the pandemic.The ongoing attractiveness of media rights revenues, the view that further value can be unlocked, and growing team valuations are all factors driving activity too. The changing regulatory landscape in sports is also reducing barriers to entry for potential investors.Women’s sport is on the rise and investment could accelerate growth. Many women’s sports are still at the early stage of professionalisation, which attracts investors who welcome greater flexibility to shape commercial structures and competition formats. Sponsors are increasingly interested in the opportunities women’s sport offers, with a number of improved commercial partnerships formed this year (e.g. Nike’s ever-growing relationship with the WNBA).

- More stakeholders are recognising the significant untapped growth potential in women’s sports but there is still a long way to go. Women’s sport historically was – and arguably still is – underfunded across all levels of play and lags behind in media exposure. In addition, women are still under-represented in senior leadership positions across sports. Increased media coverage should attract more commercial partners, which will stimulate investment in resources and talent development. The result should be a more compelling proposition for fans and greater monetisation opportunities. Additionally, longer-term commitments from brands and sponsors are required to drive further investment by leagues, federations and teams.

- Data is the currency for brand partnerships. Brands increasingly want to understand who fans truly are, what connects them and what drives their behaviours. Brands also want to co-create content. Access to digital inventories and taking a lead role in crafting the story of the content, help brands to ensure the message is authentic and impactful. It is unsurprising that respondents also identify the emphasis on cultural alignment through purpose and values. Brands and sports organisations are facing increased athlete activism, fan expectations and broader pressures to behave as good corporate citizens.

- Content owners will have to be more creative in their media rights distribution models if they are to succeed in the next 3-5 years. This is driven by the splintering of media rights as content distributors recognise the growth of streaming and digital versus traditional models

- Big tech companies are becoming increasingly active. Apple made its first significant entry into the US sports media market with its 10-year partnership with the MLS and YouTube agreed on a 7-year deal to stream NFL’s “Sunday Ticket” package

- ESG continues its rise as a major strategic priority. Environmental sustainability is widely acknowledged as an area requiring major improvement. Organisations are faced with investment and operational decisions related to complex issues such as energy use in venues, waste management and travel. Although there is a better understanding of the scale of transformation required, organisational culture often remains the main barrier to change.

- It’s still early to join the Web3 party. There are many licensing deals in the sports market financed by investors and one-off projects which to some extent point in the right direction. However, rights holders have so far not taken significant risks with Web3-based projects. Sport remains cautious and is likely to follow the lead of other industries once use cases emerge and are proven. Currently, the most popular area of application in sports is collectables (a well-known mechanism). “Virtual experiences” and “Access to communities and/or money-can’t-buy experiences” are seen as significant Web3 opportunities

- Getting a return on investment from data is a challenge. The capture and analysis of fan data is not the main challenge, but rather what you do with it once you have it

Looking for a sports sponsorship agency?

If you’re looking for advice from a sports sponsorship agency, Strive Sponsorship can help. Contact us for sponsorship strategy, partner identification, sponsorship negotiation, commercial, content, media, operations, communications, and consultancy services.

Frequently asked questions

What is sports sponsorship?

Sports sponsorship is a form of marketing in which a company or organisation pays to be associated with a particular sports team, event, or athlete in order to gain exposure and promote its brand or products. The goal of sports sponsorship is usually to increase brand awareness and create a positive association.

How do UK sports sponsorships work?

Sponsors typically provide financial or other types of support (e.g. free product or marketing reach) to a sports team, event, or athlete in exchange for branding, advertising, and other promotional benefits. The sponsorship agreement will typically include details such as the duration of the sponsorship, the specific benefits to be provided to the sponsor (e.g. advertising on the playing kit and at venues, tickets etc), and any restrictions on the use of the sponsor’s logo or branding. Sponsors usually also negotiate exclusivity clauses to prevent competitors from sponsoring the same team or event.

Do sponsorships cost money?

Typically sports sponsorships involve the payment of money or the provision of goods (e.g. products) or services (e.g. marketing expertise) in exchange for the promotional benefits provided by the sponsorship. The amount of money or value of goods and services involved in a sponsorship will depend on various factors, such as the popularity of the sport or event, the profile of the team or athlete being sponsored, and the type and extent of the promotional benefits being offered to the sponsor.