If I had a pound for every time someone had said to me ‘cycling is the new golf’, I’d be laying on a beach somewhere. But for me that term has become a double-edged sword. It shows how far cycling has come since Team Sky launched in 2010, but it has also seen cycling rights holders rely on it to sell their commercial proposition whilst doing little else to meaningfully articulate the opportunity.

Having played a very small part in the rise of UK cycling over the last six years, setting up and running Team Sky’s commercial partnership management programme, I want to share my thoughts on some of the things rights holders need to do to leverage the rise in participation and fandom of cycling, whilst delivering value back to partner brands. This is by no means an exhaustive list, just a few pointers, but the insight should help those looking to attract non-cycling brands, though the advice is largely relevant to any rights holder.

Coming into cycling I had great sponsorship experience in commercially mature sports (e.g. football, rugby, motorsport etc) but little knowledge of cycling beyond the main protagonists of Bradley Wiggins, Chris Hoy and Victoria Pendleton. All of a sudden I was in a world of passionate enthusiasts who spoke a language I could make little sense of and who were now my key stakeholders. I was expected to confidently speak to established cycling brands whilst simplfying cycling for global consumer brands.

Cycling companies were, and still largely are, staffed by lifetime industry stalwarts or ex-professionals. In order for me to establish rapport, creditability and start to appreciate their issues I needed to ride. To achieve this in as short a time as possible I signed up to ride L’Étape du Tour, which required 6 months training and a crash course in bike anatomy. I also spent as much time as I could with experienced teammates asking endless questions. It is essential as a rights holder that you make the time to understand your partner’s industries.

In addition I spent a lot of time understanding what my partners broader business objectives were, how their commercial, marketing and brand objectives supported these and what role they subsequently saw sponsorship playing. In order to be able to influence and judge return on investment, it’s vital to understand how success will be judged and measured.

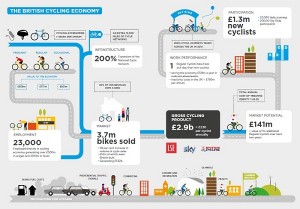

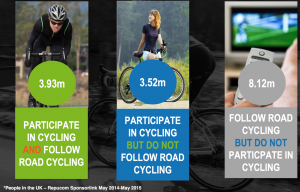

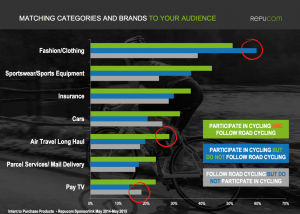

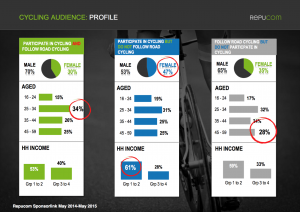

It is also important to be fully versed in who your own audience/fan base is. Whilst endemic cycling brands are largely happy to leverage value through simple association, non-endemic brands require a more detailed understanding of the broader fan engagement opportunities. Sponsors of cycling at the elite level don’t just want to engage those that ride bikes, as they’re not restricted to selling bike components, they also want to reach fans. These aren’t the same people in the UK, but are often treated that way by rights holders. 3.93m people ride and follow road cycling, 3.52m ride but don’t follow road cycling and 8.12m don’t ride but follow road cycling (source: Repucom SponsorLink May 2014-15). Ignoring fans that don’t ride, therefore, is to miss a massive engagement opportunity and therefore commercial value.

Rights holders need to recognise that brands are buying access to their audience. Sponsorship is about meeting specific objectives (creating a change in behaviour) with a defined audience using the sponsorship property as the way to reach and engage them. Therefore being able to articulate to prospective partners who audience groups are, where they are, how to reach and engage them, relevant consumption behaviour as well as how many there are, is important. This needs to be more than just an opinion as the big brands are more sophisticated than that. And if you can put this knowledge in the context of an interested partner’s target customer group, all the better. Fan segmentation studies, or database surveys, are two ways of gathering this information.

As well as understanding the profiles of your audience, you need to understand how they perceive you i.e. what are the brand attributes they associate with you and that may appeal to prospective partners (e.g. innovation, luxury etc)? Brands often use sponsorship to benefit from the halo of association so that positive attributes from your brand also get attributed to theirs. You should be measuring this anyway for your own purposes of improvement.

Many rights holders and brands see research as a cost of something you do when you evaluate activity, and even then it’s often treated as an afterthought. This is inherently the wrong approach. Insight should be used to help you articulate the commercial opportunity, inform decision-making to grow your property’s equity, help deliver partner value as well as evaluate how well you have done it. It should be seen as an investment. I know it can be hard to convince budget holders that research is worth funding and so try to put it in a language they understand e.g. you’d never coach a rider without both data and expertise, so why would you ever try and run a commercial programme purely on gut?

In 2010 developing an audience understanding was far harder for me than learning the jargon of cycling. No existing research existed. Why? Well prior to the explosion of interest delivered by Team Sky and British Cycling, there weren’t cycling commercial entities big enough to warrant significant investment by non-cycling brands at any scale. The simple fact was that the audience wasn’t deemed big enough, the sport was tainted by an unsavoury past that made it easy to ignore and there were plenty of opportunities in other sports that didn’t take as much unpicking to realise a return on investment (ROI). Many of these facts are still relevant today. Again, a lot of rights holders don’t think about this. You’re not just competing for sponsorship investment against those in your own sport, but anyone who offers a connection to a similar audience to yours.

This commercial immaturity meant that none of the market research companies had invested in syndicated cycling research and none of the sports marketing agencies had anyone with any expertise or knowledge of working in the space. I met with a number of different companies to find that their knowledge was even worse than mine. And so after a brief consultation I partnered with Repucom to pool collective resources (my cycling expertise added to their research expertise) to build what is now known as Cycling 24 (provides a team/event’s branded media value generated by TV, TV News, online and print coverage i.e. what it would cost for that exposure if you were to pay for advertising). Cycling 24 was the source of a lot of the information the authors took to write the ‘cyclingnews sponsorship report on pro cycling 2013’, and now a lot more off the shelf/syndicated data is available to buy.

Now I’m not here to argue for/against the relative merits of media value as a useful measure of sponsorship value. All I will say is, if used well, it can help rights holders understand where people are watching, which territories are most engaged (at it simplest level) and it offers a point of reference when benchmarking value against other properties (in and out of cycling). It can also highlight which news outlets carry the most coverage and which ones need further engagement to grow your media footprint, and therefore value. For a team, it should also inform kit design to maximise partner brand exposure.

Fan segmentation is another powerful tool for a rights holder. Essentially it is a deep dive into understanding the interests, attitudes and behaviours of the segments of your audience (i.e. you can build typologies). As a team this research can inform activity (for both you and your partners) that appeals to specific segments of your audience to help you grow and more deeply engage a fan base, so that win or lose, you have a robust following (giving partners a more valuable community to engage with). It also enables partners to spend less on activation and enjoy better results (i.e. delivering a higher ROI). In my experience though, it actually encourages them to spend far more.

Having a thorough understanding of the cycling landscape, and where you sit within it, enables you to dismiss sweeping generalisations and myths. It also arms you with facts, rather than opinion, to answer some of the more difficult questions brands not so close to the sport will undoubtedly ask. The cliché of ‘knowledge is power’ exists for a reason. Showing you can use insight to deliver value grows your corporate stock and unequivocally supports sponsor renewal discussions, strengthens new business negotiations and will ultimately release additional funds for more detailed research.

But don’t be fooled into thinking data is a solution in itself, just like training an athlete you require expertise and data. I often see participation data presented as evidence of interest in the elite side of a sport, which I believe is generally misleading, especially in cycling (e.g. a lot of people ride as a mode of transport). Being able to understand what data you need and how to draw actionable insight from it is a key skill for any marketing or commercial person and, as an aside, is something I think is missing in sponsorship professionals training and development. What I tend to see in commercial documents is data sourced via Google that doesn’t really relate to the specific offering at all. I also see a lot of out-dated data. This too can be dangerous, especially for a sport like cycling that has changed so quickly. Nowhere is this more pertinent than in the cycling audience types.

Six years on and people are still saying “a cycling fan is a 35 years old plus male, earns over £50k a year, works in the city, has young children and spends a lot on cycling kit”. Now this may be true (to an extent) of one segment, but it doesn’t tell you about the other types of audiences. One of the other groups are younger and growing at a far faster rate, they spend disproportionately more of their income on products they believe elevate their social status (e.g. kit) and they want help to more deeply engage with the sport. These are the people who don’t subscribe to the velominati rules and are happy to buy a replica jersey of their favourite team or rider to show support. They have different media and consumption habits as they are at a different life stage. These are the people that can provide real value, both now, and in the coming years.

This is the kind of information FMCG/global brands have about their own target customers and they would expect you to have if you went to them with a serious sponsorship proposition. I strongly believe that cycling offers up some great opportunities for brands to meet their objectives. I also believe that there is a community of people who are really keen to make this happen. My worry is that there are a lot of passionate people who don’t really know what they’re selling and who aren’t investing in understanding their own proposition, let alone what will help attract non-endemic sponsors.

To compound this I have also witnessed consultants/agencies position themselves as cycling sponsorship experts and also having little to no understanding of the audience. In some cases the brands they are advising don’t know what they don’t know and my worry is that if the right advice is not received, brands will either invest in the wrong property, overpay for rights they don’t need or struggle to meaningfully engage fans. Any of those scenarios lead to poor ROI and a probable retraction from cycling sponsorship. This isn’t good for the sport, rights holder, agency or brand.

‘Cycling is the new golf’ won’t last forever as a reason to invest. Increasingly there is a need for financial transparency in business decisions, meaning an evident return on investment needs to be demonstrated by rights holders and realised by brands. Knowing how to achieve that is key.

Strive Sponsorship provides brands, rights holders and agencies with expertise and industry knowledge across sport and entertainment (not just in cycling). Read more about Strive Sponsorship’s unique approach and Strive’s list of services.

Note: Social media data, and other free digital tools, can help rights holders of all sizes better articulate who their audience is for potential sponsors as well as help them grow and better engage their fan base. Please contact us for more details.