YouGov’s Gaming and esports – the next generation report 2020 summarises the preferences and behaviours of gamers (e.g. whether they play on mobile devices, consoles, or PCs, and whether they watch competitive FIFA games on YouTube or Fortnite streams on Twitch) across 24 global markets, deep-diving into five. Additionally, the research explores the next generation of gaming consoles, global familiarity with gaming video content (GVC) and streaming, the evolving esports landscape, and the short and long-term impact of COVID-19.

We have summarised some of this meaty 48-page Gaming and esports – the next generation report for your enjoyment below:

Platforms: Console, PC, and Mobile Gamers

- Mobile is the largest platform for gaming across all markets, skewing especially high in Asia. Still, Germany has twice as many mobile as console gamers (47% v 23%) and the UK has twice as many mobile as PC gamers (52% v 25%)

- Console, as a proportion, is big in the US, UK, Spain, Australia and (surprisingly for Asia), Hong Kong – which has the highest proportion of all markets measuring 32%

- Whilst we hear a lot about Sony and Microsoft when it comes to gaming, given their consoles, in fact in most markets console gaming is also smaller than PC gaming

- Moderate gamers (play for 1-10 hours a week) account for over half of smartphone players in every country. They amount to 60% in the UK, 12% of which game heavily (10-25hrs a week)

Gaming, gaming video content, and esports

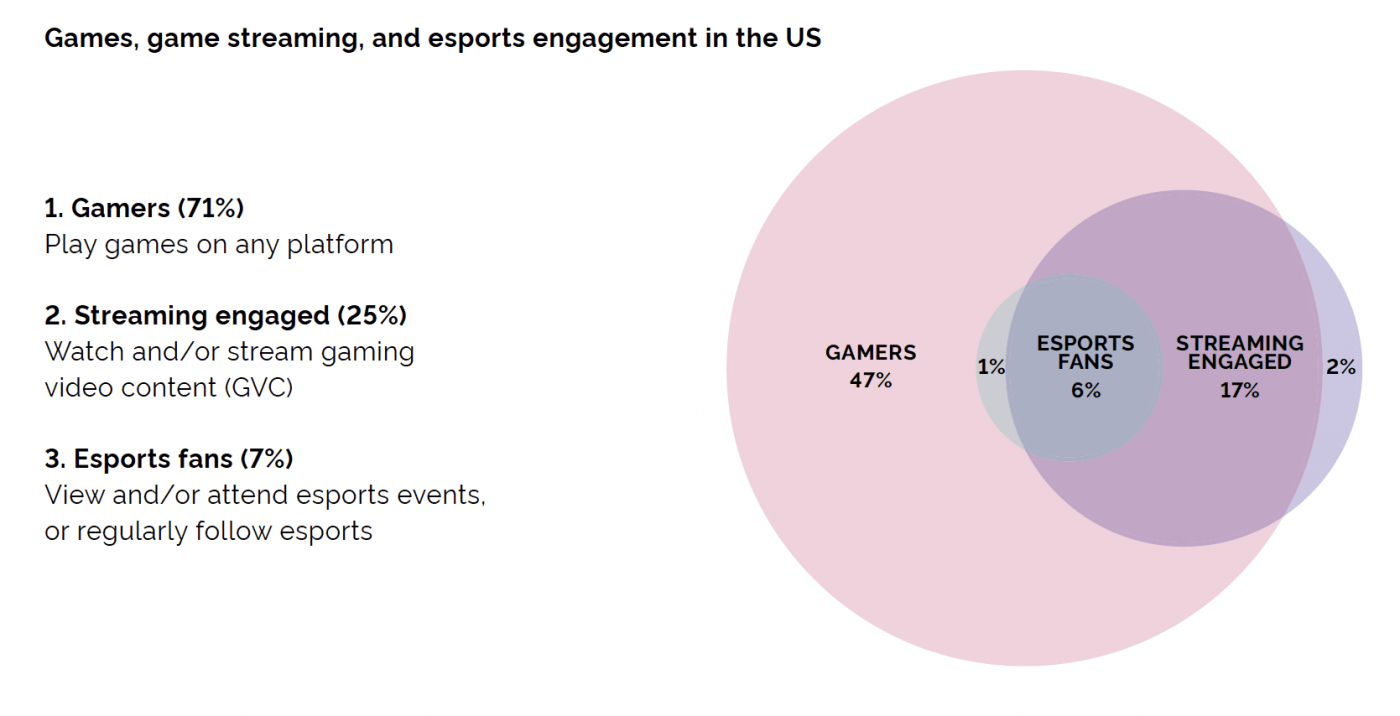

- Don’t assume that gamers (players), those who watch game streams, and esports fans will always neatly overlap. Many players do not engage with esports or gaming video content (GVC); equally, enjoying a game streaming service does not mean that a player will necessarily engage with esports

- To illustrate this, in the US seven in ten (71%) consumers are gamers, while 47% do not engage with GVC or esports. A quarter (25%) engage with GVC in some form or another; interestingly, a small portion (2%) of this audience engages with GVC alone and do not game – indicating that watching others play games is becoming a legitimate pastime in itself. The game streaming audience (25%) outnumbers esports fans (7%) by more than three to one, while the majority of esports fans (6%) also engage with GVC

- Broadly speaking, GVC viewers are a larger group than esports fans across the markets, sometimes twice the size. As a rule, esports audiences are larger in countries with a larger GVC audience. In Anglosphere markets (Australia, UK, US), the esports audience is more likely to represent a significant minority of the GVC audience; by contrast, a clear majority of GVC fans also engage with esports in East Asian and southeast Asian countries – where GVC engagement tends to be highest

Gaming video content and streaming

- Over the last 10 years, gaming video content (GVC) has developed its own distinct online subculture and even its own celebrities. Millions of viewers follow their favourite YouTube, iQiyi, and Twitch streamers as they offer commentary on the latest (and their favourite) games. For an important sub-section of players, watching video games online has become as much of a pastime as gaming itself

- Although there is a high awareness of Twitch in Europe and the US, pretty much everywhere else YouTube and Facebook is far better known

- This translates to engagement (i.e. those who watch videos, upload their own content, or both) where YouTube Gaming has significantly higher engagement than any of its major rivals in many of the 24 markets. Its advantage is particularly pronounced in Southeast Asia, whereas Twitch is strong in Europe and the US

The global esports market

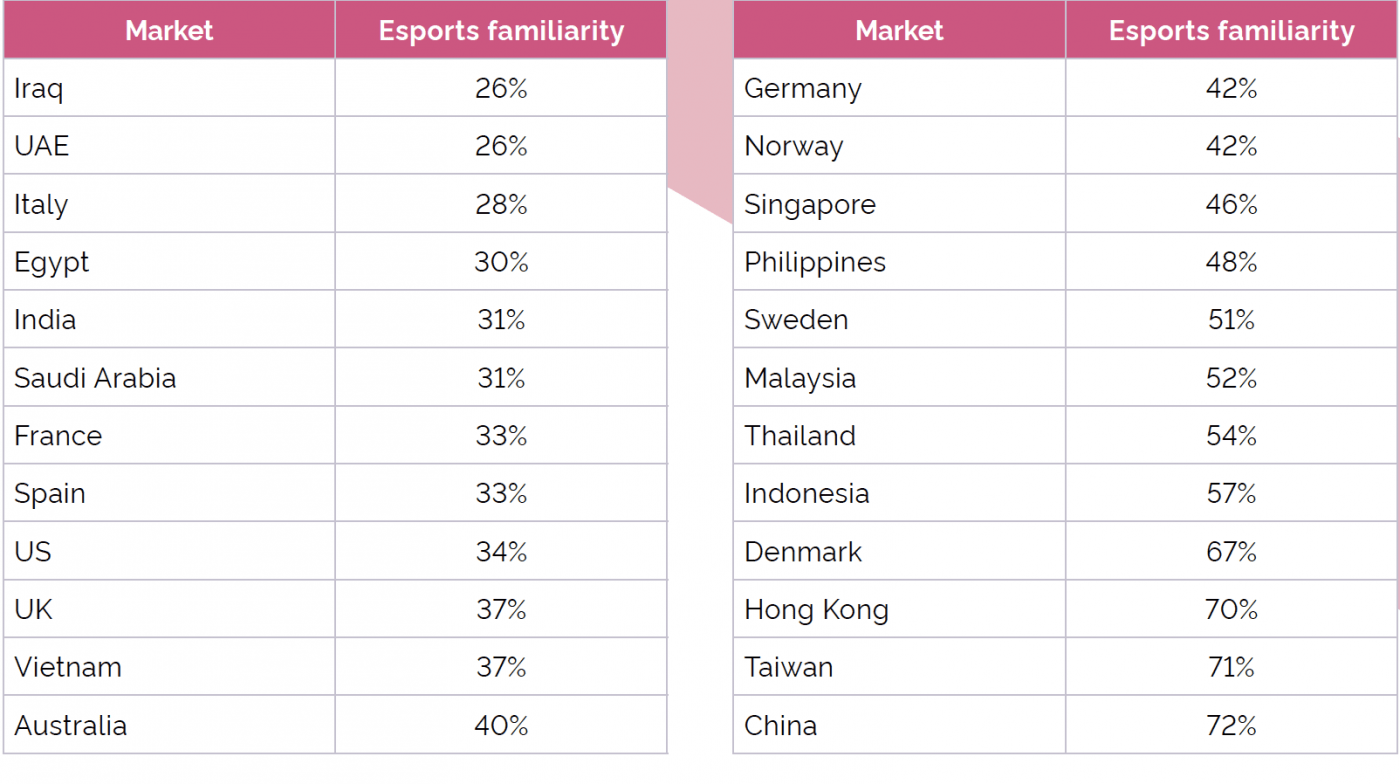

- An understanding of what esports is, amongst the general population, is still relatively low in a lot of markets. It varies from 26% (Iraq and the UAE) to 72% (China). 37% of the UK understand what esports is, with COVID-19 acting as a catalyst to broaden awareness

- Even gamers don’t necessarily know what esports is in all markets, especially in the West. This in part due to more casual and mobile gamers, who represent a large and significant group of players. Therefore developing an esports offering may first require the education of committed gamers before introducing and scaling esports initiatives

- Higher awareness of esports usually corresponds to higher engagement – but not always. Scandinavian countries are near the top of awareness and understanding in Europe, but near the bottom in regards to engagement. Of the UK’s 44% of gamers who know what esports is, only 6% engage

- How do esports fans respond to sponsorship and marketing? Well taking German esports fans (a passionate and well-established audience driven by a strong legacy of PC gaming) as a sample, and comparing them to football fans (Germany’s most popular sport), suggests esports can provide brands with opportunities to engage a receptive, yet also discerning, audience.

- 74% of esports fans are likely to notice the sponsors of events that they watch versus 58% of football fans

- 54% of esports fans are likely to love it when their favourite team has cool sponsors, versus 39% of football fans

- 53% of esports fans agree that if a company sponsors their team, they will buy its products – compared to three in ten 31% of football fans

- Esports fans are three times more likely than football fans (23% v 7%) to strongly favour brands that sponsor one team only

A deep dive into hardcore US gamers

- 77% of hardcore gamers (spend 21+ hours a week playing video games on a console or PC) are men, versus 49% of the general population

- Two-thirds (65%) of hardcore gamers are aged 18-45 and do not have children, compared to just 30% of the US general public

- 17% of hardcore gamers enjoy a wide social circle, versus 15% of the general population. However, 26% of hardcore gamers can’t stand socialising, twice as much as the general population

- Hardcore gamers have a wide interest outside of gaming

- 34% say they are not interested in any sports versus 49% of the US public. The most popular sports among hardcore gamers are the NBA (24% compared to 11% of Americans) and the NFL (23% vs. 21%)

- Hardcore gamers are twice as likely to cite the UFC (13% hardcore gamers; 6% Americans) and wrestling (13% hardcore gamers; 5% Americans) as sporting interests

- Some 44% say they’re passionate about the FIFA World Cup compared to a fifth (20%) of the wider country

- More intuitively they are also significantly more likely to follow esports (12% vs. 2% of Americans)

- They’re also more likely than the general population to have a passion for sports. When presented with the statement “cycling is my passion”, two in five (58%) agree compared to just 14% of the US public. When presented with a similar statement about tennis, a third (33%) agree with 12% of Americans overall

- Hardcore gamers also favour technology e.g. 46% want to buy a wearable next to 17% of the US public overall

- Brands targeting hardcore gamers with digital advertising will struggle. 69% have installed ad-blocking software compared to 47% of the US public. This is one of the reasons sponsorship has become a popular brand activation for esports – brands can integrate directly into broadcasted and VOD content to ensure reach and exposure

To download the Gaming and esports – the next generation report 2020, please click here.

If you’re looking for advice from a gaming and/or esports agency, Strive Sponsorship can help. Contact us for sports, gaming, and esports strategy, sponsorship, commercial, content, operations, investment, and communications consultancy services.