If you’re after a European sports fan research report, YouGov’s ‘The many faces of sports fans across Europe’ is a decent place to start. The report looks at sports audiences in eight markets – Denmark, France, Germany, Italy, Norway, Spain, Sweden and the UK. In each market, it examines a range of subjects including:

- Favourite sports

- Prestigious sports events

- Fan demographics

- Fans’ media consumption – by type and amount

- Social media use

- Brand preference

Highlights from the European sports fan research report include:

Favourite sports properties (note: this has been calculated by asking people if they watched or followed a sports event or league over the past year. Strive’s perspective is that ‘watched’ may indicate reach better than preference/favourite and so this should be considered when reading the output)

- Football properties are the favourite in four of the eight markets, including the UK, with 21 appearances out of a possible 40 top five spots

- Nine different sports appear across the countries top five

- The UEFA Champions League is the most popular property, appearing seven times out of the eight top-fives. Maybe surprisingly, the Tour de France and Formula 1 come next with three top-five rankings each

- Domestic football leagues make an appearance in every top five. This is no surprise given the volume of games and the ‘watched’ element of the research may skew these results somewhat

- Rugby’s Six Nations only makes the top-five in the UK

- In Sweden sport in general commands less interest with only 14.2% of the population watching/following their most popular sports property. Five fifth-placed sports in other countries beat this. The UK has an even split, whilst Italy has the biggest disparity between first and fifth place

Prestigious sports events

- Maybe unsurprisingly popularity doesn’t equate to prestige. The Olympics and tennis properties are seen as the most prestigious in six of the eight countries (three each). Wimbledon is deemed the most prestigious in the UK

- Perception of prestige tends to be fairly steady, illustrating the power of brand to influence and the investment and time needed by competition brands to change the perception

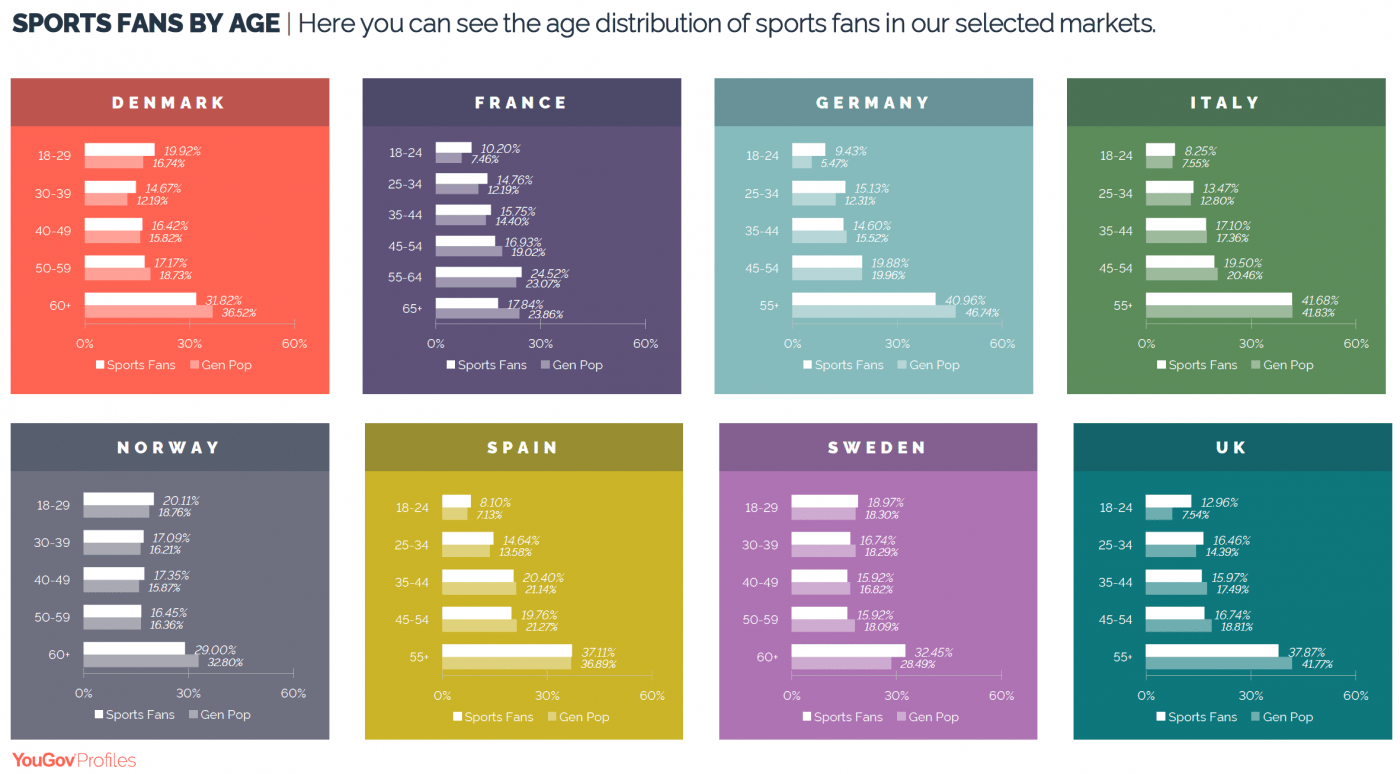

Fan demographics

- In almost every market people are more likely to be sports fans the older they are

- This is attributed to younger people having a wider interest range, different media consumption habits and lower disposable income (making following the sports harder). We would suggest that lowering participation levels and greater competition for attention than previous generations (e.g. from gaming and social media) is also having a negative impact on sports fandom

- The UK suffers the most of any country. In its youngest age category (18-24yrs old) it under-indexes compared to the general population the most. Additionally, 74% of sports fanbase is male, the most lopsided gender balance across all countries

- This is recognised by UK sports governing bodies who are launching numerous efforts to attract younger people, and especially women, into a sport

Media consumption

- In general, sports fans TV habits are the same as the national population across all markets

- Social media use by sports fans varies across markets, with the exception of Facebook which is consistently the most visited platform. Note, that isn’t to say it is the most visited for sports content, just that it is the one used the most

- Instagram is the second favourite across five of the eight markets

- German sports fans are the lowest users of social media

- Given the age of sports fans, it is probably of no great surprise to learn that TV is the dominant medium for live sports consumption across all markets

- Interestingly the UK and Spanish sports fans are most likely to watch on a mobile phone

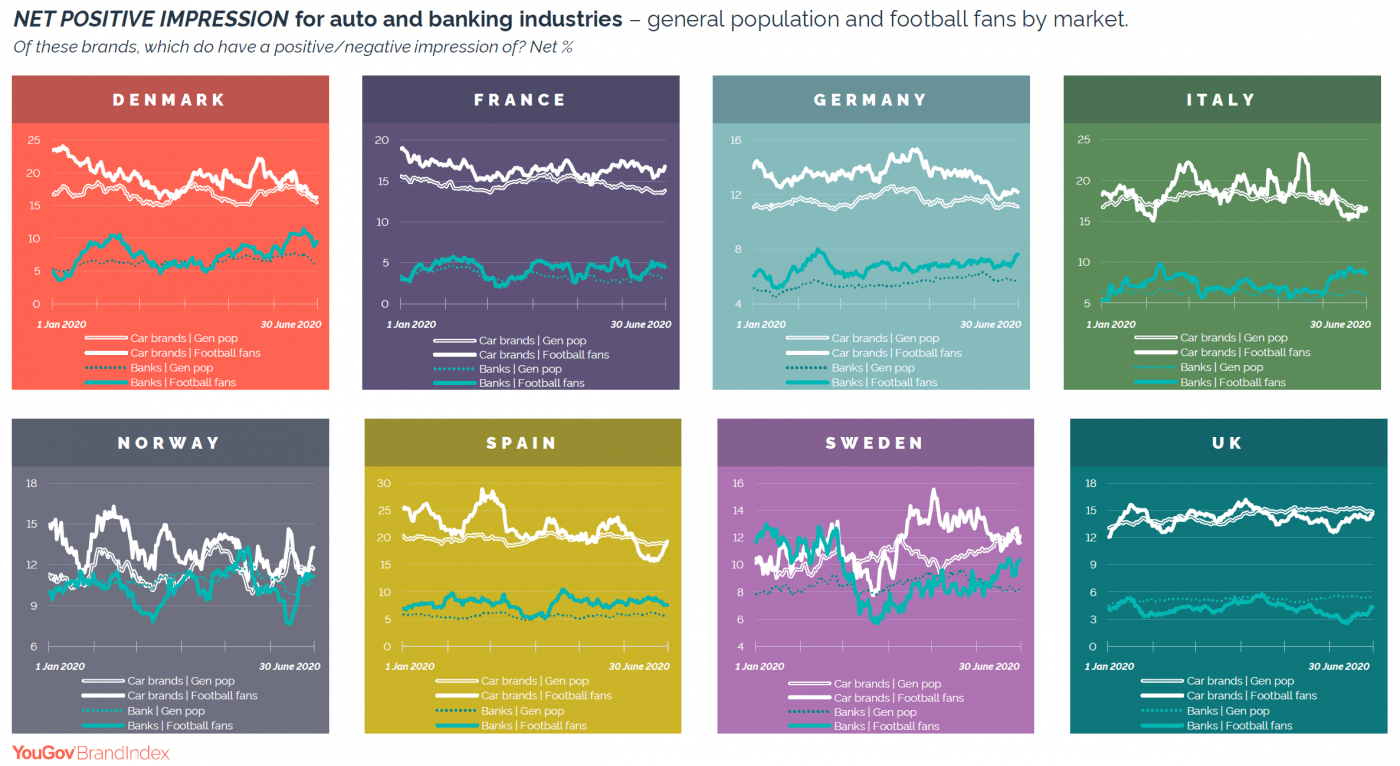

Brand preference

- Interestingly in the UK the net positive impression of car and banking brands are lower in football fans than the general population. In the most part, across all other countries, the reverse is true. It could be, therefore, that sports sponsorship by these two categories actually has a negative rather than positive impact on the brand association. Maybe one for Barclays to think about!

Click here to download the European sports fan research report 2020.

If you would benefit from the advice of a sports and/or esports agency, Strive Sponsorship can help. Contact us for sports and esports strategy, sponsorship, commercial, content, operations, investment, and communications consultancy services.