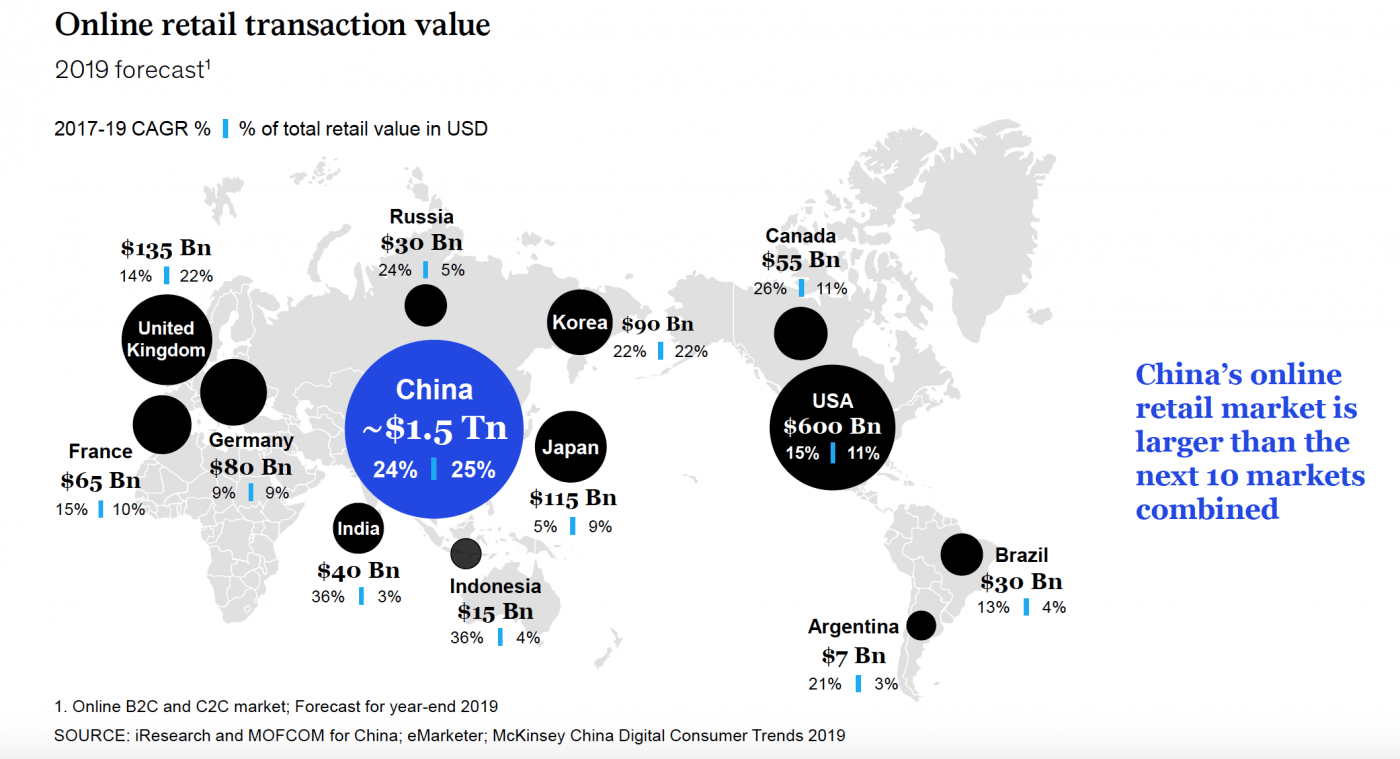

McKinsey’s China Digital Consumer Trends Report 2019 surveyed digital consumers from across city and rural areas in China to better understand their digital behaviour. They asked them questions about their digital activities, how they allocate their spending and their purchasing decision journeys. Why is this important? In 2019 online retail sales in China are expected to swell to USD $1.5 trillion, representing a quarter of China’s total retail sales volume, and more than the retail sales of the ten next largest markets in the world – combined.

China’s 855 million digital consumers – among some of the most avid users of mobile phones and social media in the world – represent one of the biggest prizes for global brands which by default makes it important for both sponsor brands and rights holders. From the latter’s perspective, they need to both understand it to build audience and engagement, but also to monetise directly. Additionally, however, they need to understand it from their partner’s point of view in order to best deliver value back to them. The China Digital Consumer Trends Report 2019 explores five major areas of opportunity for consumer-facing marketers that may help:

- Digitally-powered physical retail innovation: Crafting an intentional strategy to tap into omnichannel behaviour

- Social commerce: Monetising social attention and engaging with consumers through direct-to-consumer (DTC) channels

- Small town youth: Identifying the next pocket of customer growth

- Key Opinion Leaders/Consumers (KOLs / KOCs): Fine-tuning the levers of consumer influence

- Sales events and discounts: Data-enabled pricing and promotions

Some of the difficult themes tackled in the China Digital Consumer Trends Report 2019 include:

- Omnichannel shopping: Looking beyond the hype, are initiatives like omnichannel retail services really taking off in China, and where should we place our bets to capture a return on our investment?

- Social media and commerce: China is the land of social media, and some brands are already monetising the attention they are generating through social channels. How can we tap into the trend? How can we start building relationships directly with consumers that enable us to collect more granular and actionable data on them?

- Lower-tier cities: Most marketers have focused their attention on capturing consumers in high-tier cities. But with more than 50 per cent of digital consumers residing in lower-tier cities, how can we craft a value proposition that appeals to them?

- Key Opinion Leaders/Consumers (KOLs/ KOCs): KOLs/KOCs wield a lot of influence, but how should we tailor our strategy to drive short-term sales while building the brand?

- Shopping events and discounts: The major annual and semi-annual shopping events like Double 11 and 618 are playing an increasingly important role in driving sales. But what impact are these events having on our profitability, and are there other ways to leverage these events beyond slashing prices?

Click here to download the China Digital Consumer Trends Report 2019.