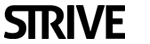

The changes to sports broadcasting and distribution report 2021 takes a closer look at the changes to broadcast and distribution and what this potentially means for the future. Seven League, the authors of the report, believe sport is characterised by three ages and that we are now entering the third age. In this latest age, digital disruption is restructuring how sports are being enjoyed, consumed, discovered and monetised. This is reshaping the business model for sport and it’s creating new opportunities.

The changes to sports broadcasting and distribution report 2021 covers the following topics:

- The First Age of Sport: Emerging mass media brought news of events to ever bigger followings. The status of athletes and teams grew to a national level before travel enabled competition on a global scale. Technology shortened the distances between sports fans throughout the 20th century, with live radio and TV audiences spawning an industry and inspiring a commercial formula.

- The Second Age of Sport: Guarantees of a substantial viewing audience meant that media rights for major sports events because financially valuable to broadcasters, who began paying higher and higher fees to sports organisations for exclusive coverage, paid for by advertising dollars.Satellite and Cable TV created space for specialist media, whilst also heavily influencing the economics of the market. Dedicated channels speculated on premium events and the most successful were rewarded with stable subscription growth (e.g Sky TV’s strategy to buy up Premier League football)This spurred a surge in media spending and transformed the warning potential of athletes, teams, federations and promoters.

- The Third Age of Sport: The dawn of personalised on-demand digital media has disrupted the exclusive media rights model. The biggest sports rights holders can depend on international fan interest at scale. For the small players, however, uncertainty reigns.Every sport can have a global reach but must wrestle with the rights strategy of business to business, direct to consumer or a balance of both. The breadth of opportunities for sports content distribution has never been greater.

- The Media Rights Model Threat: The growth in value of broadcast rights has insulted the sports industry for a generation as the pay-TV sector has taken on the risk of monetising the audience.The digitalisation and globalisation of consumer media have changed that. Cord-cutting and unbundling (where viewers stop paying for cable packages) have presented challenges. Meanwhile, the emergence of relatively low-cost over-the-top (OTT) players like Amazon and Netflix has presented another threat.Legacy media companies are not focused on developing global digital offerings to match this and shutting down operations these new offerings have replaced. Add COVID-19 to the mix, and all this has led to a downward trend in rights value.

- Modelling A New Approach To Sports Broadcast: Although players like Netflix and Disney (i.e. Disney+) have introduced direct to consumer global entertainment products, it’s not yet clear what the right model for sport will be.There are currently two paid OTT approaches being tried. One is a pay-tv sports broadcaster (e.g. DAZN) and the other is a single sport product (e.g. GolfTV) serving a hyper-engaged audience.

- The Streaming Wars: For most sports rights holders preparing for the next age of broadcasting and distribution it will be about what to show where. However exclusive access will be reviewed, with fans finding what they want via non-competing channels e.g. Sky’s experiment in putting the women’s edition of The Hundred on YouTube for free, figuring this will grow reach rather than cannibalise its own coverage.

- New Ways of Live Sport: Sports businesses are assessing new ways to watch and monetise sport online. Versioning of content to specific groups of fans is being trialled.

Click here to read The changes to sports broadcasting and distribution report 2021 in full.

If you’re looking for advice from a sports media agency, Strive Sponsorship can help. Contact us for sports, gaming, esports, metaverse, sponsorship, commercial, content, media, operations, investment, and communications consultancy services.