Any sponsorship practitioner worth their salt will tell you that measuring a sponsorship’s effectiveness by a single measure has little intrinsic value, not least if that measure is advertising value equivalent (AVE) i.e. the value of brand (logo) exposure in media is attributed a value based on what it would cost to advertise. However used as part of a bank of relevant metrics, it can have a role to play in sponsorship decision making and in optimising certain elements of campaigns etc. For that reason the esports sponsorship exposure trends report 2021 may be of value to you. Please note, the report only accounts for Q1 of 2021 and compares to the name period in 2020.

The main themes and headlines from Blinkfire’s esports sponsorship exposure trends report 2021 are:

- Sponsorship exposure trends –

- Top 10 esports brands by engagement – adidas replaces ESL as the most engaged with brand, moving up from seventh place in 2020. This reflects the growing number of team deals the brand is underwriting. Logitech maintains second place and FIFA moves up from sixth to third

- Top 10 esports esports brands by category – apparel, consumer electronics, non-alcoholic and beverages account for 90% of the top 10 most engaged with brands, evenly split between them. In 2020 consumer electronics made up 50% alone

- Top 10 brands by engagement: esports vs non-esports – unsurprisngly apparel brands gain the most exposure in and out of esports. Given the ubiquity of performance wear, and its visibility, this skews results. Maybe more interesting is that despite the heavy investment by car makers in esports, the value generated by sport is still far greater. Two car brands make the top 10 in exposure value in sport, whereas none do in esports

- Content trends –

- Instagram – Instagram posts made up 13.3% of esports image and video content across all platforms in Q1 2021. This is substantially more than 2020, showing its growing importance as a channel e.g. stories grew 56.5%

- Twitch by the numbers – as esports and gaming matures as a marketing platform, more brands are entering the fray across sponsorship, paid for media etc. This is reflected in Twitch streams where we now see 3.69 brands per post, a 36% increase compared to Q1 2020 showing an increased saturation

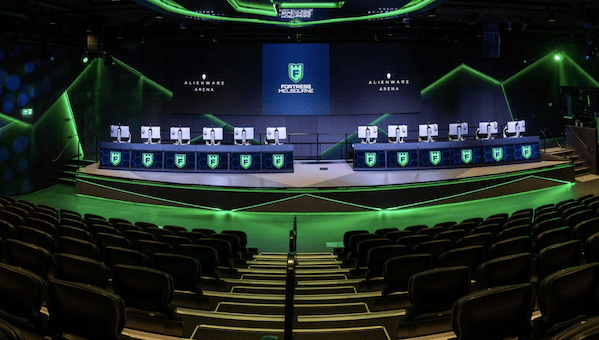

- Assets and ‘scenes’ – the sponsorship assets generating the most exposure for brands are uniforms, branded backdrops (step and repeat), chairs, headphones and monitors – in that order. In sport the value of backdrops is vastly less due to the small amount of time the athletes spend in front of them, however in esports, where players are static, the backdrops are more comparable to pitch side signage than traditional interview backdrops. Scenes are what are more commonly called content themes. In esports the most popular (and therefore valuable content to be associated with as a brand) are birthdays, scores, and action.

- Streaming report

- Esports fun facts –

- Posts with a player drove 260% more engagement than posts without players, showing the importance of talent

- Posts from esports influencers and players drove 38% more engagement than esports teams, leagues, and organisations. This shows personal deals could offer more value than team/league deals for certain campaign objectives

- The more hashtags used, the greater engagement of posts e.g. Posts with one brand hashtag averaged 66% more engagements than posts without any. Posts with three brand hashtags averaged 475% more.

- Esports and influencers –

- Esports influencers (i.e. content creators) drove more than 50% of Twitch’s total time watched compared with pro esports players, teams, leagues, and organisations

- On Instagram, influencers averaged 218% more engagement per post that pro esports players, and 245% more engagement per post when compared with esports teams, leagues, and organisations

Click here to read the full esports sponsorship exposure trends report 2021.

If you’re looking for advice from a gaming and/or esports agency, Strive Sponsorship can help. Contact us for sports, gaming, and esports strategy, sponsorship, commercial, content, operations, investment, and communications consultancy services.