As esports matures it attracts increased attention from established agencies and sees the birth of new ones. The demand for data and insight to inform and evaluate decision-making is one major driver of this. Esports has also been a gateway into a wider awareness and understanding of gaming and streaming, where again information is sought. This has culminated in a number of different companies publishing freely available streaming, gaming and esports statistics and charts. We have included some of the latest ones we have found useful below.

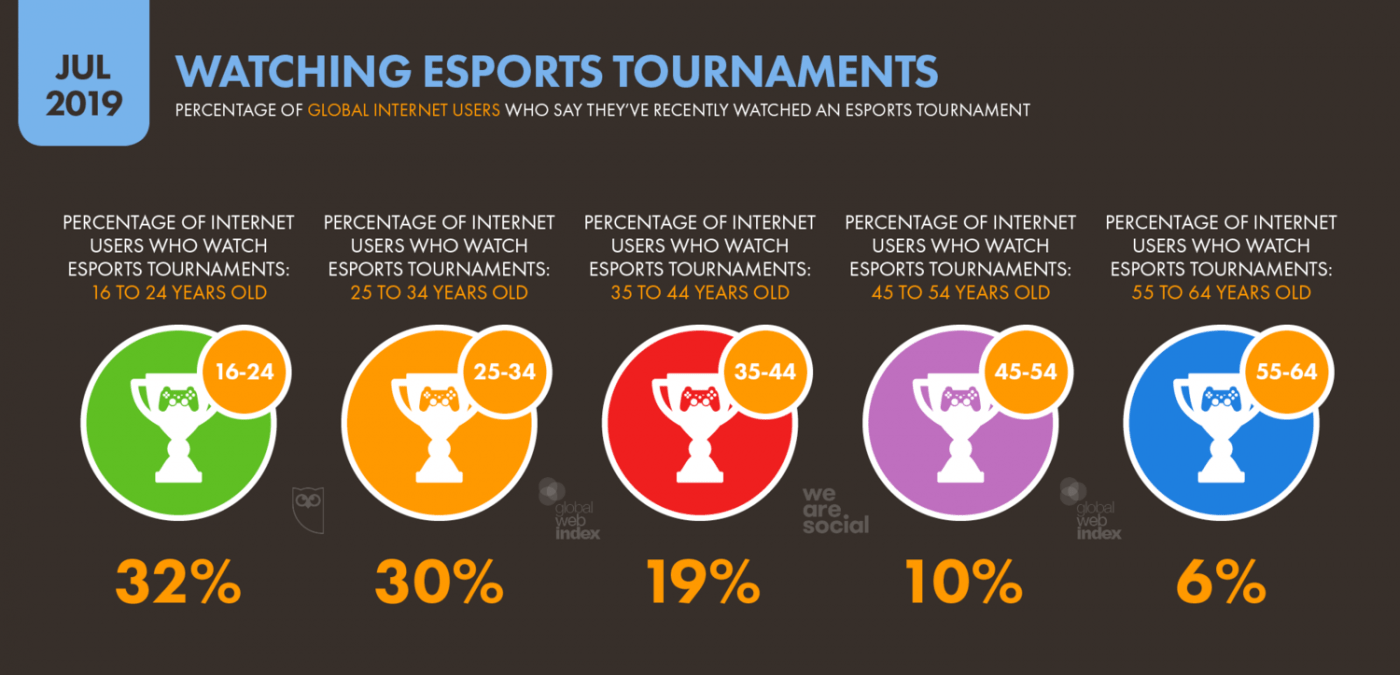

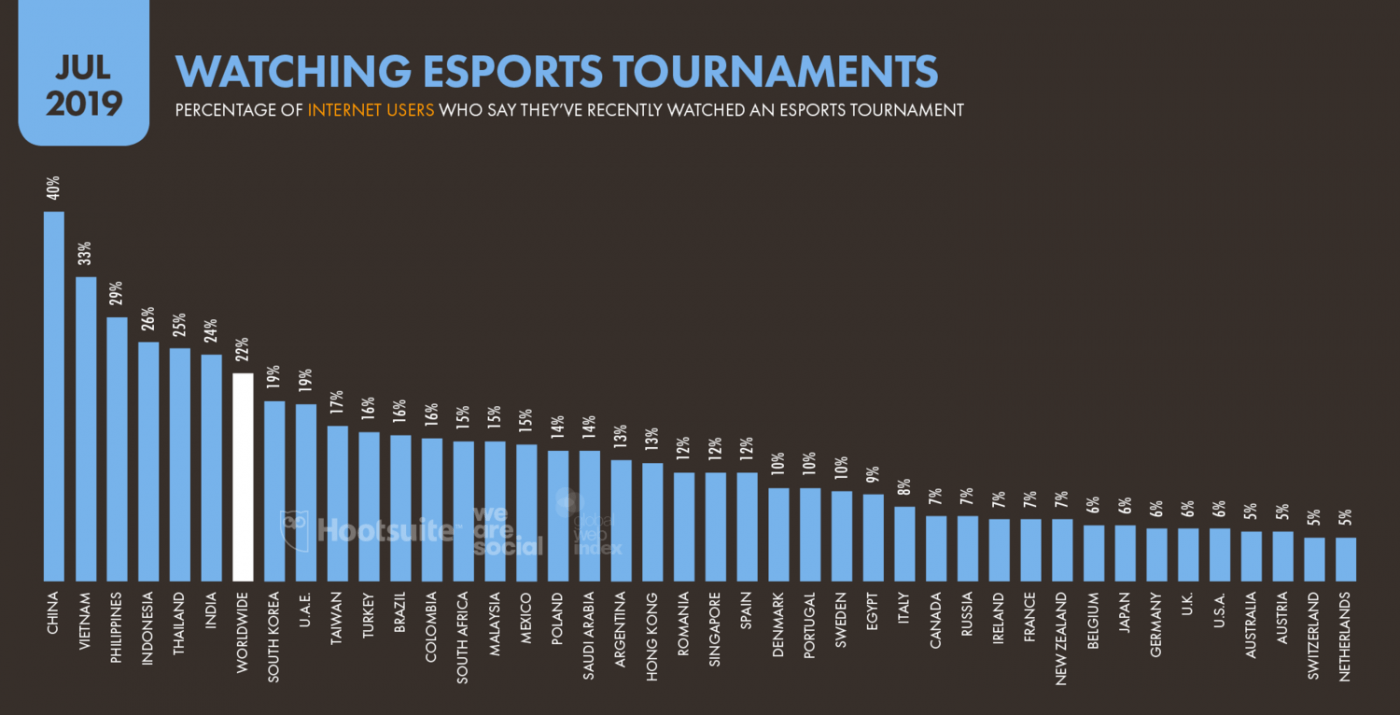

GlobalWebIndex produces a series of digital-focused reports using data from a wide variety of sources, including market research agencies, internet and social media companies, governments and public bodies, news media, journalists, and their own internal analysis. Their Q3 2019 global digital statshot included some interesting esports statistics. Find below a summary of these below.

Nearly a third of global internet users aged 16-34 years-old report that they have recently watched an esports tournament.

Over a fifth of all internet users globally report that they have recently watched an esports tournament.

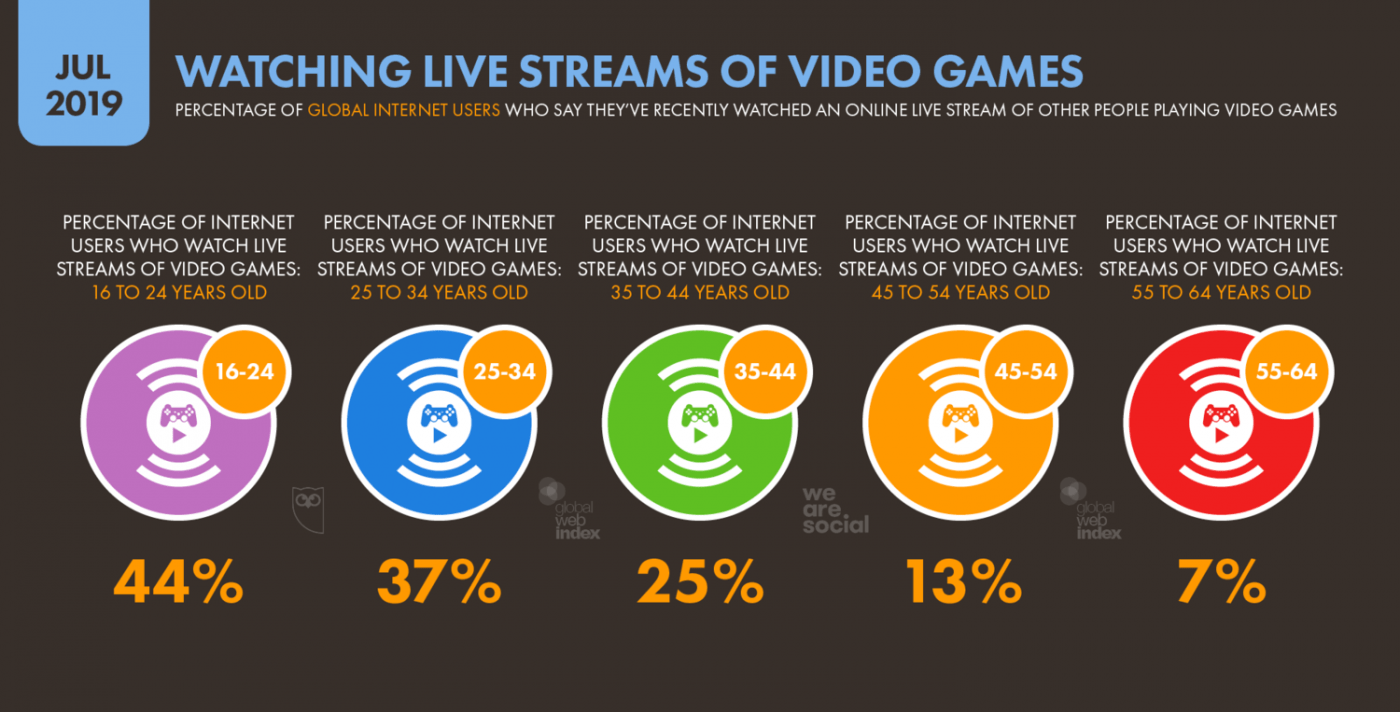

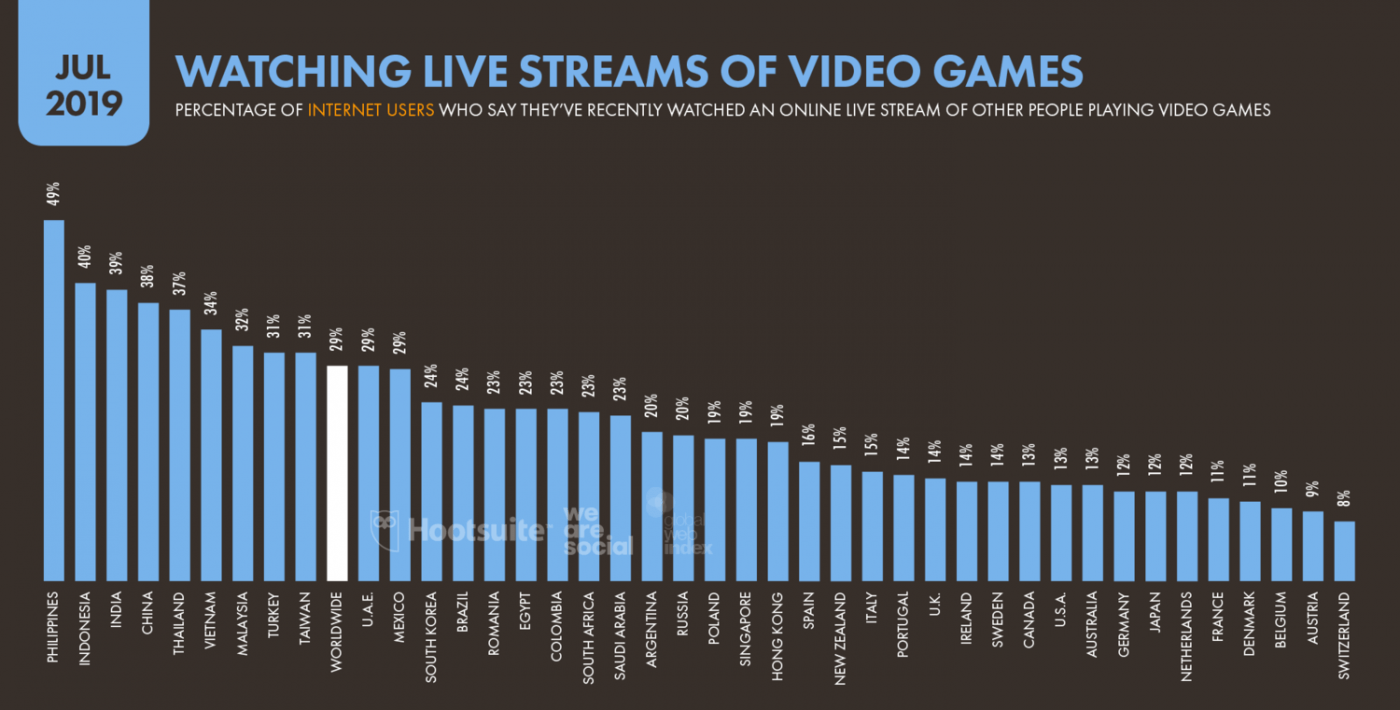

Around 40% of global internet users aged 16-34 years-old report that they have recently watched a live stream of other people playing video games, with a quarter of 35-44 year-olds reporting to too.

Nearly a third of all internet users globally report that they have recently watched a live stream of other people playing video games

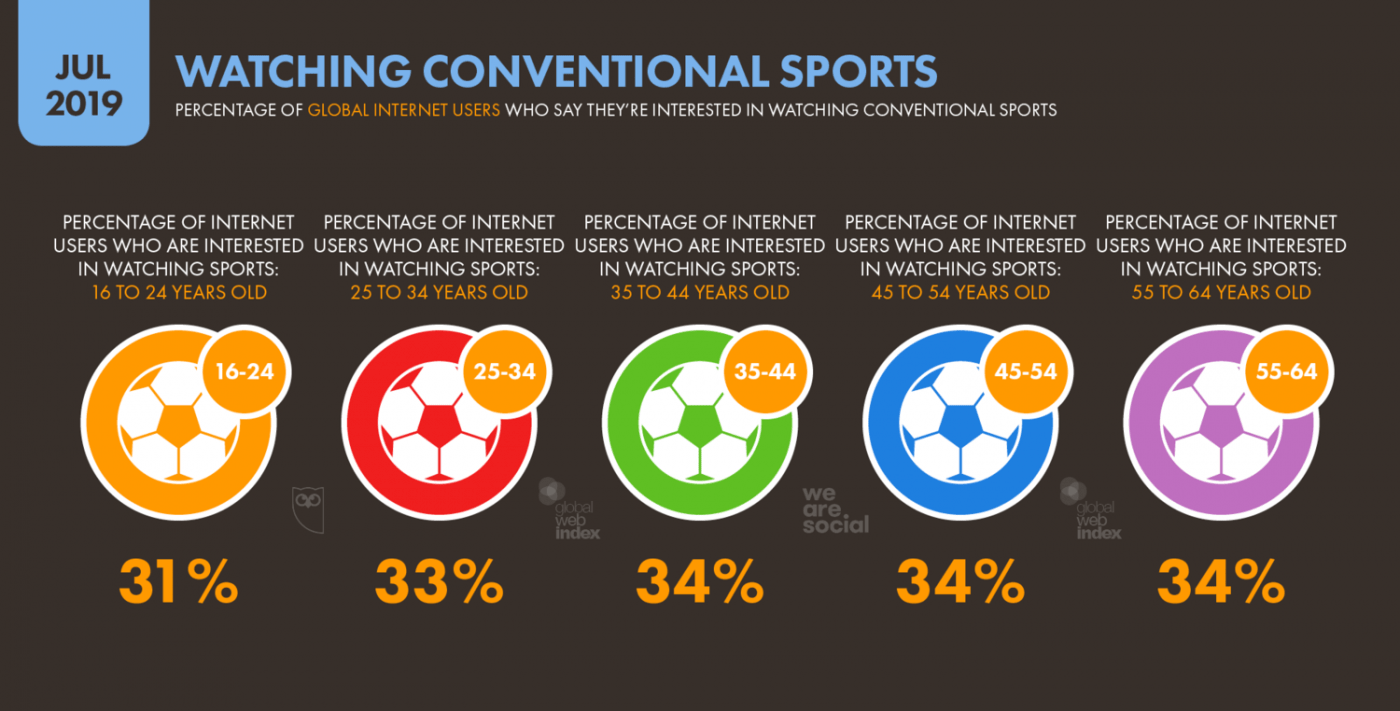

Esports viewers compare favourably to global internet users who say they’re interested in sports, especially in the 16-34-year-old age groups where the figures are almost identical. Watching gaming content is even more popular than both in the same age category.

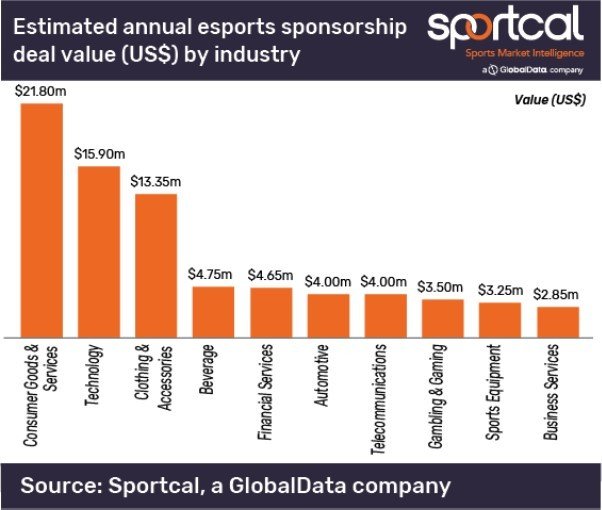

FMCG brands have been the most active in esports sponsorship in the US, according to Sportcal – a well-regarded global provider of sports market intelligence. Technology and clothing and accessory brands are not far behind according to these figures published in 2019.

Much of the focus of discussion around esports revenue generation has been on sponsorship and media. One of the overlooked areas, much like it is in sport, however, is that of cause sponsorship spending – often referred to as corporate social responsibility (CSR) spend.

According to Wikipedia, CSR initiatives aim to “contribute to societal goals of a philanthropic, activist, or charitable nature or by engaging in or supporting volunteering or ethically-oriented practices.” An example of this in practice in sport might be a coaching clinic for disenfranchised youth. Lots of sports teams run a variety of initiatives like this as part of their good citizen role within the local community in which they are situated.

The value of this spend to teams manifests itself in a number of different ways and there are a number of trends that esports commercial teams need to be aware of in order to benefit fully:

- Doing good is good business, so says Sir Martin Sorrell. Purpose-led marketing has seen a surge as businesses want to be seen more than just a seller of products, but as a brand that stands for something. Therefore that means there are a lot of businesses looking to spend money in this way

- A rights holder working with a corporate partner in this way will get the benefit of the feel-good factor from fans (and therefore positive brand attribution)

- It is a more tax-efficient use of money by businesses. Some countries (e.g. the UK) allow pre-tax revenue to be spent on CSR initiatives, whilst others attach other benefits that mean it is more economical than traditional post-tax marketing spend

- As you can see from the statistics below, spend is growing at a faster rate than sponsorship spend

- The budget resides in a different part of a business than marketing spend and with different decision-makers, meaning there are potentially larger post of money with the same organisation available and/or more opportunities for investment

- There is less competition for spend as a lot of rights holders don’t realise this is an opportunity

Newzoo is a well-established esports and gaming research agency that often provides useful esports statistics. They regularly publish esports, gaming and streaming industry data, insights and forecasts. See below for their esports trends to watch in 2020.

- Riot Games launch of a new mobile game is sure to have been done with esports in mind. With the esports industry maturing, and mobile esports already popular in Asia, it would be no surprise to see it grow further in the west, given the right games.

- We are already seeing more esports-related in-game cosmetics available to buy. Only recently Rocket League announced the addition of new in-game skins for competitive esports teams.

- As esports organisations embrace data and become more sophisticated in their reporting they are coming to realise that the value of tournaments is not just to sponsors, but the cities where events are hosted too. In 2019 Riot Games recorded a €2m to Rotterdam’s local economy in just two days, and we’re bound to see more of these reports as organisers look to offset competition costs through government grants and sponsorship by tourism bodies.

- The increase in the number of esports franchised leagues continues in 2020 with Activision’s launch of the Call of Duty League

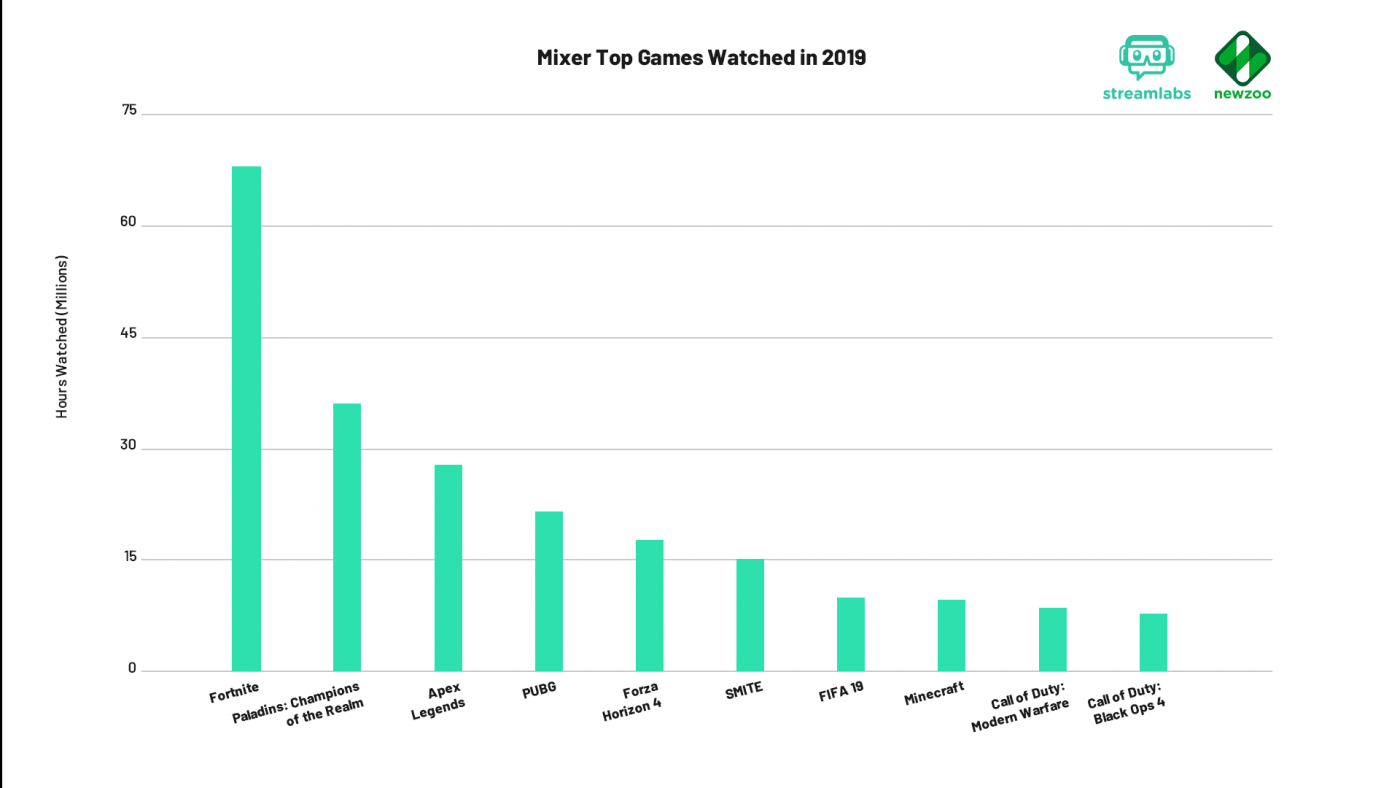

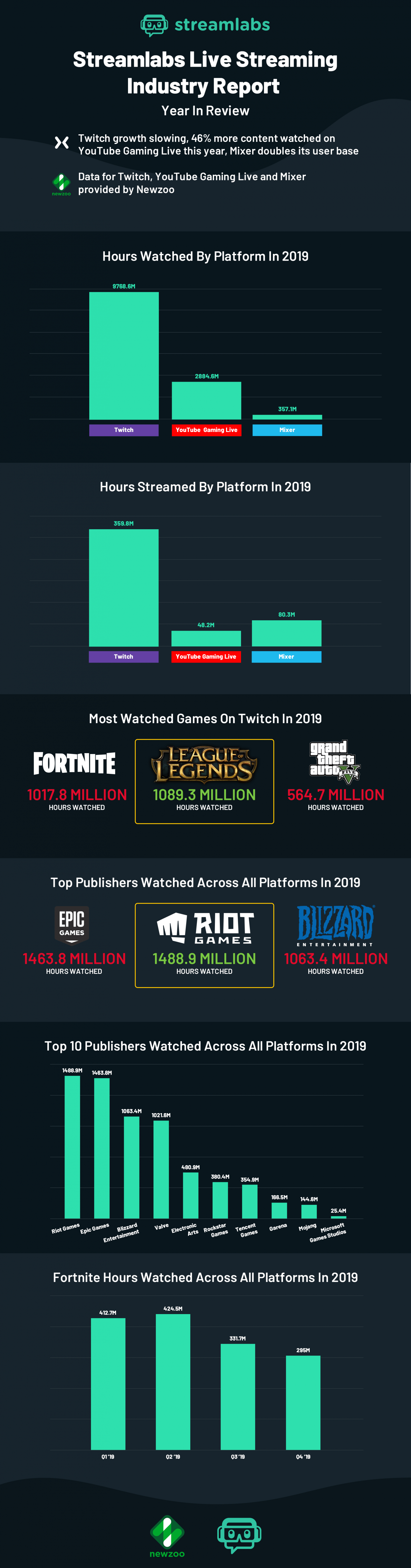

Streamlabs and Newzoo collaborated to provide the Live Streaming Industry Report 2019. There are some really useful charts here that show the start in what may be a shift in the balance of power amongst streaming platforms. The main takeouts they found from their research were:

- Twitch is still leading but experienced an overall decline in 2019

- The total hours watched on YouTube Gaming Live increased by 46% from Q1 to Q4 in 2019 and accounted for 27.6% market share in terms of hours watched for Q4, up 7% since last quarter

- Last quarter, YouTube Gaming Live was the only platform to see an increase in hours watched, streamed, and concurrent viewership

- Mixer more than doubled its number of hours watched and streamed when comparing 2019 to 2018 (no doubt due in part to the number of streamers they signed who traditionally streamed on Twitch)

- Mixer has nearly the same number of unique channels streaming on the platform as Twitch. Mixer also has more than triple the number of unique channels compared to YouTube Gaming Live

- Riot Games was the most-watched publisher of 2019 across all platforms, beating Epic Games by 25.1 million hours

- 28.5% less Fortnite content was watched in 2019 than in 2018

xxxx

If you would benefit from the advice of a gaming and esports agency, Strive Sponsorship can help. Contact us for gaming and esports strategy, sponsorship, commercial, content, operations, investment and communications consultancy services.