Each year, research firm Nielsen interview a panel of industry experts from across the world, to find out what the global sports industry commercial trends are. They overlay this with insight from the work they do with clients internationally. This culminates in the production of the Top 5 Global Sports Industry Commercial Trends 2018 report.

The trends are summarised below, but for the in depth analysis check out the full top 5 global sports industry commercial trends 2018 report.

1. Distributor disruption – One of the biggest questions for the sports business today is whether media rights revenues will sustain at current levels, as the traditional TV business is disrupted. In developed markets, pay television has been a major revenue stream for over 20 years. Now it’s a business under pressure from market saturation, a change in audience media consumption habits (e.g. “cord-cutters” & “cord-nevers”), low-priced OTT services etc.

These factors are negatively impacting content budgets. Many see the tech giants of Amazon, Netflix, Facebook etc as possible saviours. We’re not sure we agree. If it’s one thing that all these tech businesses have in common, it’s an understanding of what audiences (and therefore broadcast deals) are really worth. We predict that their better understanding of consumer value, when compared to those selling the rights, added to the change in market conditions, will in fact mean they pick and chose what they want carefully. Thus an increase in competition won’t necessarily mean an increase in media rights revenue. And eventually, they will all monetise these audiences better than the existing commercial rights holders, all things remaining equal, and indeed rights holders may get to a stage where they’re more reliant on reaching their audiences through these platforms than the platforms are on the content. This is where the direct to consumer model (D2C) may make more sense.

It is this pressure on legacy revenue streams for rights holders (as sponsorship budgets too are under pressure, as decision makers struggle to understand and articulate return on investment versus their digital marketing peers), and a lack of innovation in finding new ones (rather than just trying to squeeze all they can out of what they’re already doing) that has led Strive launch a new venture development part of the business.

Details will be available soon, but in essence, Strive will be helping sports and entertainment businesses identify, test, build and deliver new businesses that monetise their audiences in new ways. The approach has already been used with large established brands outside of sport and entertainment, and we believe the lean and agile methodology used has the potential of making a significant impact on the industry. If you’d like to know more, do let us know.

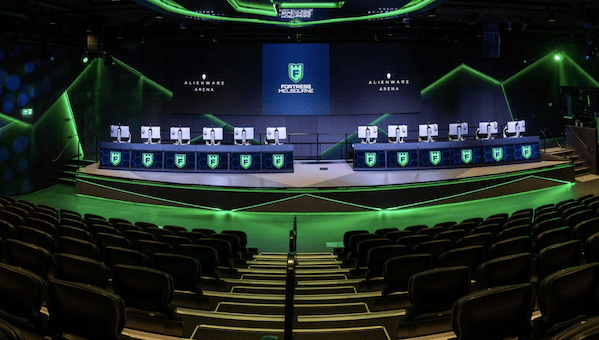

2. Esports evolution – Efforts to commercialise esports are intensifying, as the businesses become more mature, investment increases and expertise is hired in. The sector continues to enjoy strong growth, with 34% of UK esports fans becoming so in the last year and the European investment scene starting to build momentum, but still some way behind the US and Asia.Games publishers are playing a more active role in building businesses around the esports scene, in relation to their own titles.

Activision Blizzard’s Overwatch League is one of the most prominent example of the change in approach. Blizzard has adopted familiar elements from traditional sports to create the global league: franchise teams, league-wide partner brands and an exclusive media rights deal. Eyes are on it to see if Blizzard can build the large global audience it is aiming for.

There has been a lot of media coverage around sports teams signing up esports players, but in reality the relationship between traditional sports and esports is only just beginning. Many sports are still working out how to connect with the sector. Strive Sponsorship has identified 11 different commercial models that have been adopted globally to date. We expect this to only increase.Whilst non-endemic brand involvement is a few years old in the US, only now are we starting to see a number of moves in Europe. Audi, Mercedes, Lynx (Unilever), adidas, New Balance and Domino’s to name just a few.

3. Content rules –Sport delivered via television screens remains the core sports media product. But with attention spans shortening, people becoming interested in a wider variety of things and mobile media consumption increasing, much of the battle for audience attention and engagement is taking place elsewhere.

The low barrier to entry for publishing on social media has created a new generation of digitally native sports media, often driven by young people producing content in a tone of voice familiar to their peers – the likes of Dude Perfect in the U.S. and JOE Media in the U.K. Sports, brands and traditional media are increasingly partnering with these new players to create compelling new content formats.

As the quality, volume and variety of content increase, it will be harder and harder to cut through. Going forward sports, brands and media will experiment with new technologies such as voice activation, VR, AR and chatbots. In turn digital media will continually give birth to new influencers and publishers, appealing to different generations and segments of the audience. And rights holders will explore ways of monetising the new types of content, through sponsorship and subscription products.

4. Sponsorship to partnership – It’s sad to say that it has taken until 2018 for mindsets across rights holders to change in any great number to adopt a richer, two-way relationship. Rights holders now need an account team with a broader skillset and understanding of marketing at large, than they have previously.

As a start point they need to understand:

– Who their audience segments are, and how and where to engage them

– How they are perceived by their target audiences, and what power to influence partner brand perception they have

– Be clear on their own businesses objectives, and specific role in helping deliver these through partner collaboration

– Understand their partners objectives, target audience(s), brand, positioning and broader marketing campaigns

– Have a view on assets and engagement programmes that can deliver return on investment for partners and themselves, beyond just a rights fee

– Be a consultant to partners, not just a gatekeeper of assets

As such, data is playing a great part in successful partnerships. Key is understanding what the right questions are to ask, what data is best to help inform and evaluable decision making by answering these questions and then having the ability to synthesize this and having the courage and permission to implement decisions off of the back of it.

At the moment a lot of rights holders are trying to outsource this capability by buying technology solutions that they think will provide a silver bullet solution. Whilst technology will no doubt play a part, it needs the right people to leverage it. What rights holders should really be doing is investing in their people and hiring personnel with a broader marketing knowledge than just sponsorship.

5. Sports in our changing society – “Doing good, is good business” said Sir Martin Sorrell at an event we were at four years ago. And with 66% of people willing to pay more for brands committed to positive social and environmental change, it’s hard to argue against that.

Equality, diversity, gender, race, sexuality and the environment, among other issues, are dominating the media and having an impact on every part of the sports business. In sponsorship, brands are demanding impeccable ethics from the sports they partner with. Sports can’t have total control over their athletes and ambassadors, but anyone doing less than their utmost to run an ethical organization or competition is taking a risk.

Going forward spending will increase on sponsorship campaigns that exhibit brands’ credentials on diversity, sustainability and other social issues. Sports that cannot demonstrate their social usefulness will lose business to those that can.

However authenticity and credibility will be key. Any green washing will be quickly called foul, damaging the rights holder and associated brands rather than elevating. This approach will need be consistent across how the rights holder engages fans as well as how it operates as a business.

To download the top 5 global sports industry commercial trends 2018 report, click here.

If you would benefit from the advice of a sports agency, Strive Sponsorship can help. Contact us for sports sponsorship, commercial, content, operations, investment and communications consultancy services.