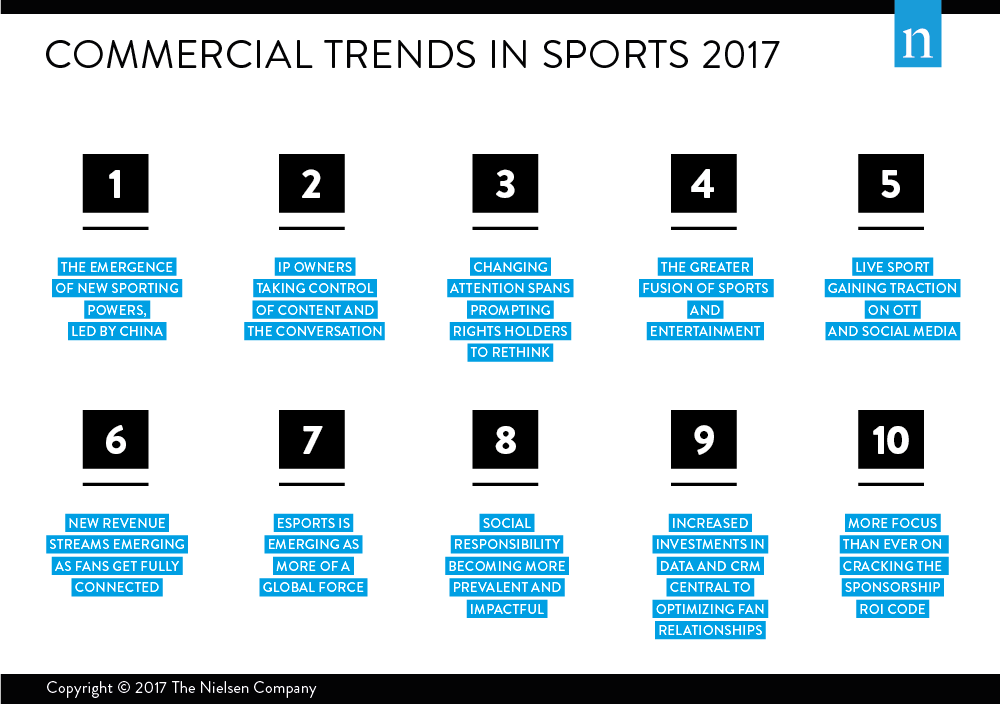

Nielsen Sports ‘ Commercial trends in sport 2017 ’ summarises the key changes we are seeing across the commercial landscape in global sport sponsorship.

“Politically, socially and technologically, the world is in the midst of one of the most disruptive periods in living memory—this disruption is affecting where investment in sports is coming from, how sports content is created and distributed, and changing the dynamics of relationships between rights holders, sponsors and fans.

With global sponsorship spend forecast to reach over $62 billion in 2017 and global media rights spend expected to hit $45 billion, the top-line metrics remain positive. But this is a period of rapid change for sports—from China’s remarkable investments at home and abroad to new technologies such as virtual reality, the explosion in direct-to-consumer content to shifts in audience habits and consumption.

Nielsen Sports has analysed the changes happening across the worlds of sports, media and technology by listening to the industry, examining the relevant data and carefully considering the impact of these changes. With the help of our experts around the world, this whitepaper outlines what we regard as the 10 major commercial trends in sports” says Nielsen Sports.

According to Nielsen Sports, what do these trends mean?

- The emergence of new sporting powers, led by China: Emerging markets are increasingly engaging with and investing in top-level sport: the next three Olympic Games will be staged in Asia, while Russia and Qatar are the next two FIFA World Cup hosts. But China is leading the way. The government target to create a US$813 billion sports industry by 2025 has fueled major investment across all aspects of sports – in events, facilities, teams, leagues and grassroots programs. Alibaba’s long-term partnership with the International Olympic Committee and Wanda Group’s new partnership with FIFA have made headlines but both companies are laying foundations in other sports too.

- IP owners taking control of content and the conversation: From Presidents to the person on the street, this is an era when everyone has the ability to be a broadcaster. And content has never been more prized or valuable. Two major property acquisitions in 2016 underlined the point: WME-IMG’s acquisition of Ultimate Fighting Championship (UFC) and Liberty Media’s acquisition of Formula One were, ultimately, investments in content and intellectual property. Rights holders across the board, meanwhile, are looking to add value by developing their own content, often in partnership with brands or broadcasters but sometimes on their own. Athletes, too, are becoming their own media owners in various ways – from dedicated apps and YouTube channels to larger investments in digital publishing.

- Changing attention spans promoting rights holders to rethink: Across sport, rights holders are examining ways to repackage, relocate and reposition events to better suit the changing structure and behavior of the fan population. Nielsen Sports’ research shows that people are intensely interested in fewer things, but generally interested in more things. Amid major competition for attention, the impact on rights holders is significant and leading to many examining and pushing ahead with tweaks to scheduling – the NFL’s introduction of Thursday Night Football and the Premier League carving out a package of Friday night live games, for example – and format changes. Twenty20 cricket is the prime example, but a host of other sports are developing and commercialising shortened versions. To add to the competition for attention, entirely new sports, such as drone racing, are emerging.

- The greater fusion of sports and entertainment: Rights holders and venues across the world of sports are on a constant quest to enhance the spectator experience – at events and for those watching remotely – by adding entertainment elements, such as concerts, fan zones and enabling more access to star athletes. Taylor Swift’s pre-race concert at the 2016 United States Grand Prix and the Super Bowl half-time show for example. Similarly, there are many examples of new entertainment events built around a sports element, including Andy Murray Live, an evening of music and exhibition tennis, and the Kellogg’s Tour of Gymnastic Champions, a 36-city tour of US Olympic gymnasts designed to capitalize on the team’s success at Rio 2016. The NFL and Cirque du Soleil, meanwhile, have partnered to create a major showcase installation in Times Square, due to open in 2017.

- Live sport gaining traction on OTT and social media: Thanks to technology, fans have come to expect content – live streaming, on-demand coverage and supporting statistics and analysis – to be available to them whenever, wherever. Over-the-top live content is coming to sport, with established broadcasters, newer digital publishers, rights holders, telecoms firms, social media platforms and technology giants all engaged in some form. Amazon, Google and Apple are all active in content creation and delivery, while rights holders are actively developing and experimenting with their own media models – PGA Tour Live, the Olympic Channel and Dugout, the collaboration between 30 major football clubs, are all examples. These rights holder-owned channels can also generate data, giving a richer, deeper picture of the audience and opening up new potential revenue streams around merchandise, tickets and content.

- New revenue streams emerging as fans get fully connected: The introduction of features such as Facebook, Twitter and Instagram Live has given all stakeholders opportunities to deliver live sport, or secondary content, directly to consumers, while at the same time opening up more options for user-generated fan content. Mobile is increasingly the device of choice for fans to consume and share content. All stakeholders are innovating to connect with fans via smartphone, including broadcasters like NBC, who rolled out a dedicated app and launched a partnership with Buzzfeed for Snapchat content during Rio 2016. Different rights holders are at different stages of their digital journey: some are focused on fan acquisition, others on fan engagement and the most sophisticated on monetisation.

- esports is emerging as more of a global force: The esports market is growing to a point where it is regarded as a serious proposition by established sports. With esports still maturing as an industry, however, many established sports currently view it as a way to engage a young, much-prized audience. The Philadelphia 76ers NBA team last year became the first North American sports franchise to acquire its own esports team, while Samsung acquired its own team in 2013. Formula E, the electric motorsport series, stages parallel esports events at all its races, while several European football clubs have hired their own esports players. The major stakeholders in the esports industry – game publishers, distributers like Twitch, tournament organisers and teams – are all facing commercial challenges familiar to those faced by organisations in established sports. They will inevitably look to learn and gain relevant best practice from the sports industry.

- Social responsibility becoming more prevalent and impactful: As demonstrated by a number of adverts which ran during Super Bowl LI, which focused on activism, inclusivity and diversity, it is increasingly important for brands to adopt a position on major societal issues and outline how they are making a positive difference. Rights holders and sponsors are increasingly building corporate social responsibility components into partnerships, be it Bayern Munich working with adidas to produce a shirt made of recycled ocean waste or Commonwealth Bank’s major investment in women’s sport through a long-term collaboration with Cricket Australia. At the same time, there is pressure, from the public and media, to modernise and raise standards in all aspects of sports, from major event bidding processes to the fights against doping and corruption, athlete behavior to combating match fixing and illegal betting.

- Increased investments in data and CRM central to optimising fan relationships: An investment in gaining a more detailed understanding of audiences and fans – who they are, but also what makes them tick and how they behave – can not only pay dividends in terms of offering more refined, tailored content; it also opens the door to potential new monetisation possibilities, via membership schemes, OTT broadcast subscriptions and retail. The smartest rights holders are already using their in-depth knowledge of their fan base to ensure brand partners are activating in the most effective way. The smartest brands are already demanding such information from their sponsorship property. The power of CRM to optimise all aspects of the relationship with a fan is undeniable. The target for rights holders is the application of accurately collected data to achieve customised solutions, through rigorous analysis and segmentation of fans.

- More focus than ever on cracking the sponsorship ROI code: The need to justify sponsorship decisions is increasing for all stakeholders. Data is driving decision-making at all levels of the most sophisticated sports organisations – board members, marketing leaders, financial analysts and others all require ever more detailed evidence that their decisions are the right ones. Quantifiable tracking is a must for brands and more bespoke analytical frameworks are being created to assess the relative performance of assets. Looking ahead, rights holders are beginning to predict the return on investment a brand can expect during the pre-sales process, while Nielsen is working to match sponsorship exposures with retail sales to connect the dots and provide ongoing tracking of how a partnership is performing. The models are becoming more sophisticated but one golden rule remains. As one Chief Marketing Officer for a global brand aptly put it: “If you can’t measure it, you can’t manage it.”

Click here to download the full report.

If you would benefit from the advice of a sports agency, Strive Sponsorship can help. Contact us for sports sponsorship, commercial, content, operations, investment and communications consultancy services.