Newzoo, a gaming and esports specialist research agency, has released it’s latest data report ‘Why sports and brands want to be in esports’. It features a comparative analysis of American sports and esports, reasons out why brands and rights holders investment in esports is growing and presents a pen portrait of a digital native esports enthusiast.

We’re big advocates of research and insight , as if understood and used properly, we believe it can have a positive influence as part of a marketeers decision making process. We have referenced a lot of Newzoo information in our work with brands and rights holders to date, and believe quality research is key to engaging, and retaining, non-endemic brand investment into esports. However we often see data being misunderstood, and therefore misused. It is important to take time to understand what you’re reading so that your conclusions, and any insights drawn, are sound.

We have included some observations on this particular report below to ensure brands, rights holders, broadcasters, media and other agencies fully understand the context of the information provided. To be clear, this is not a criticism of the information Newzoo has provided, the comments are purely included to make people stop and think what the information is actually saying so if used, it is applied correctly.

Why sports and brands want to be in esports

- Reaching the unreachable: the millennials

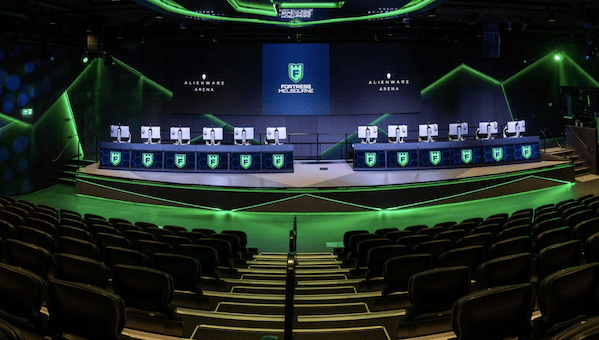

- Games have become a global spectator sport

- A multibillion dollar business in the making

Comment: This free report deals with a US audience only. The monetisation figure is relevant only to esports rights holders (and investors) as it looks at spend on things like tickets, merchandise etc.

Popularity of esports by age

- 22% of US male millennials watch esports

- 65% of US esports enthusiasts use Instagram vs 44% of online population

- esports is as popular as baseball and more popular than ice hockey

- 58% of US esports enthusiasts have a very positive brand attitude towards Nike vs 42% of gamers

Comment:

- US male millennials may not be indicative of share in other territories

- ‘Online population’ doesn’t seem to be defined anywhere. Ideally you’d want to compare like with like e.g. US male millennials who are esports enthusiasts vs US male millennials who aren’t

- esports is like saying sport, it is the collective term for competitive gaming across a number of different genres and game titles. Really we should be comparing specific esports titles to individual traditional sports, or esports to sport, to get a direct comparison

- ‘Gamers’ haven’t been defined. It’s good to have a consistent comparison set when looking at these kind of stats

The digital native esports enthusiast

- 42% own an iPhone vs 38% of the online population

- 35% have a Spotify subscription vs 13% of the online population

- 22% watches ESPN vs 13% of the online population

- 52% have a HBO subscription vs 29% of the online population

Comment: As per comment 2 in Popularity of esports by age

Click here to download Newzoo’s ‘Why sports and brands want to be in esports’ report.

If you would benefit from the advice of an esports agency, Strive Sponsorship can help. Contact us for esports sponsorship, commercial, content, operations, investment and communications consultancy services.