- Global music revenues increase 3.2% as digital revenues overtake physical for the first time

- Digital sales contribute 45 per cent of industry revenues; overtake physical’s 39 per cent share

- Streaming revenues up 45.2 per cent, helping to drive 3.2 per cent global growth

The global music market achieved a key milestone in 2015 when digital became the primary revenue stream for recorded music, overtaking sales of physical formats for the first time. Digital revenues now account for 45% of total revenues, compared to 39% for physical sales.

Total industry revenues grew 3.2% to US$ 15.0 billion, leading to the industry’s first significant year-on-year growth in nearly two decades. Digital revenues now account for more than half the recorded music market in 19 markets.

Brand Partnerships

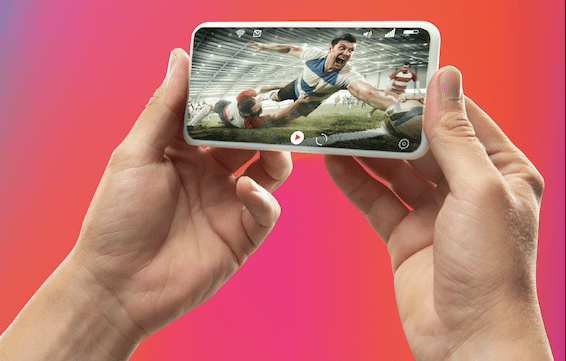

What is clear is that the flow of revenue back to artists is an issue. This highlights the growing importance of brand partnerships to deliver direct value back to the artist, as well as giving them new and additional marketing platforms to build audience reach.

Brand partnerships have been an area of greater investment for record companies over the last few years. They have expanded their teams responsible for this area, often recruiting people with backgrounds in creative, media and sports agencies to bring in the expertise they need. Partnerships can range from sponsorship deals in which artists endorse products, to arrangements that see record companies bring to bear the breadth of their developing artist rosters and create new content.

Brand partnerships are a key part of record companies’ services to artists. A great deal of work goes into ensuring that the values of the artist and brand are aligned, something often missed in the commercially more mature sports sponsorship industry. Part of this is about labels analysing comprehensive data about the reach of their artists, but it is more about the artists being the creators of their content, rather than participants in it, and so being more connected (and therefore protective) of their art. Whilst restrictions may not seem ideal for brands at first look, what it helps ensure is authenticity of relationship which helps translate into creditability, and therefore greater engagement, with audiences.

Olivier Robert-Murphy, global head of new business at Universal Music Group, says:

“Brands are experiencing a revolution in how consumers interact and engage with them. Entertainment in general and music in particular not only provides access to audiences but also helps brands become culturally relevant and meaningful across the board. The best marketers today know that loyalty is in short supply and so they have to deliver experiences and emotions that tap right into people’s desires and aspirations. Those brands that successfully create emotional engagement are the ones that succeed in turning customers into fans.”

Record companies are aware they have competition from other businesses in this area and that brands have other options. Camille Hackney, head of Warner Music’s Global Brand Partnerships Council, says:

“Brands have the option of tying in with films, television, social media stars or sports franchises, but music offers an incredible opportunity to harness fans’ passion and engagement which is increasingly played out in social media.”

Speaking a Brand’s Language

Whilst music labels are doing a much better job of using research and data to understand artist audiences, they still haven’t quite managed to translate this into the language the majority of brands speak. Often the decision makers at brands for music partnerships are the same as for sport and other platforms. Music labels need to spend more time understanding how brands assess and measure return on investment (ROI) for these platforms, so they can put their own music offerings into context by speaking the same language as the brands currently do.

This is slowly changing, but labels need to start seeing research as an investment rather than a cost, to help them target the right partners, understand value and be able to illustrate ROI to partners in a relevant and compelling way. As an example, the value of product placement in music videos is usually assessed based on the cost of the video production, rather than the value enjoyed from the prominence of the brand in the content. Obviously video production cost has very little to do with brand exposure and so is a poor choice of measure.

Often the big piece missing in these conversations though, is communicating the effect brand partnerships have on enhancing brand perception. This isn’t exclusive to music partnerships, as most sports right holders still haven’t quite caught on to this either, however developing a better understanding of this would open up the three different budget areas of a company that labels could tap into i.e. marketing/advertising department, sponsorship team and the CSR function.